Where Have All The Buyers Gone?

Do you think The Rembrandts formed in 1989 with the life-long goal of writing a song that would be used as the theme for a hit American sitcom?

Or is it possible that, despite the fame and royalties that come with the honour, perhaps these bands would almost prefer not to be type-casted for the rest of their careers, and labelled as one-hit wonders?

Phil Solem, the writer of “I’ll Be There For You,” which was used as the theme for Friends, said in 1995, “”We don’t want to hang our hats on the theme from a TV show…[w]e’ve been working too long at our craft for that.”

I also heard him say in a podcast that The Rembrandts don’t receive much in the way of royalties.

What a shame!

I wonder if Paula Cole made out better with the theme song from “Dawson’s Creek?”

Admit it: to this day, you still get goosebumps when you hear Paula’s voice offer, “I don’t wanna wait……..for our lives…..to be o-ver….”

I know I do.

But did you know that the original theme sone for “Dawson’s Creek” was supposed to be Alanis Morisette’s hit song, “Hand In My Pocket?”

I can’t imagine the show having the same feel.

And Alanis wasn’t a one-hit wonder, which is almost a pre-requisite for having the theme song of an American sitcom.

Then again, Paula Cole wasn’t either.

Surely you’ve heard the song, “Where Have All The Cowboys Gone?”

Of course!

But did you do the mental math? Did you put two-and-two together and realize this is the same voice from the Dawson’s Creek theme song?

While “I Don’t Want To Wait” has 97 Million plays on Spotify and “Where Have All The Cowboys Gone?” has only 29 Million, I think the latter is a far better song.

Satirical in nature, and written by a feminist and regular at Lilith Fair, the song has some exceptional lines:

Why don’t you stay the evening?Kick back and watch the TVAnd I’ll fix a little something to eatOh, I know your back hurts from working on the tractorHow do you take your coffee my sweet?

I’d better keep this in mind the next time I complaint to my wife about my back…

I will raise the childrenIf you pay all the bills

Wait….this is satire, right?

I will wash the dishesWhile you go have a beer

Phew!

I don’t drink beer.

And in my house, I do most of the dishes. I mean, I wash, but damn if I don’t hate unloading the dishwasher…

References to John Wayne and the Marlboro Man notwithstanding, I’d like to think that after today’s blog is posted, we see a few more plays of this song on Spotify or wherever you get your music.

It’s a classic.

And when I wondered aloud, “Where have all the buyers gone” over the long weekend, I heard Paula Cole in my head.

I can’t help it. This is how my brain works.

And somebody out there can relate. Whether you simply know me by now, and my penchant for the “folksy intro,” or whether your mind works the same…

Paula Cole wrote that song for the feminists out there. It was supposed to be satirical and sarcastic.

But so many other people saw this as a true call for a manly-man to take care of an otherwise lost and lonely woman; a call to return to more traditional times!

The parallel to the question, “Where have all the buyers gone” should not be lost on anybody.

Just as Paula Cole’s song had the opposite effect of what was intended, I think the same can be true of our real estate market in May of 2024.

Before we get to to the question itself, however, I think a refresher is in order.

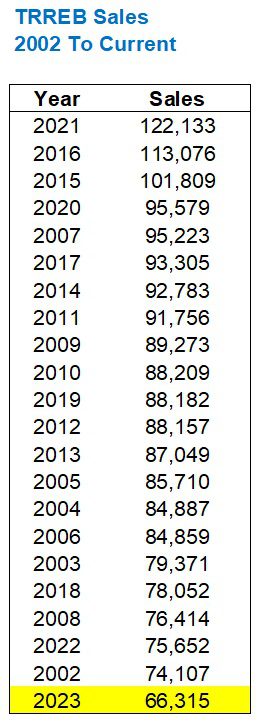

Last year, we saw the lowest number of sales since I started charting this data in 2002. I want to say “of all time,” but surely there were fewer sales in 1998 when the city was half the size, so years ago, I selected 2002 as my starting point.

Looking at this chart, which outlines the yearly sales in chronological order, you can already see where some people will start to formulate their answers to the question, “Where have all the buyers gone?”

Sales peaked in 2021.

Post-pandemic.

Ultra-low interest rates.

And so on.

But two years later, sales hit bottom. Rates increased, sure, but that can’t be the only reason that sales slowed down, right?

At the risk of being repetitive, I want to show you the same chart but in numerical order:

Sales in 2023 were just about half of what they were in 2021.

That’s a pretty stark contrast, no?

And again, I would expect that the conclusion here is simply “Interest rates went up, sales went down.”

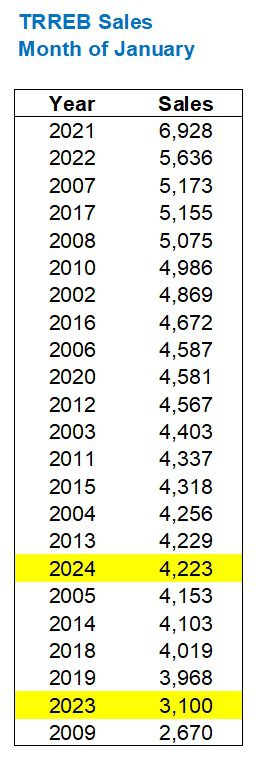

As for how 2024 is faring in general, and/or in comparison to 2023, consider this:

In January, sales were up by 36.2% over January of 2023.

That’s good, right?

But remember, sales in January of 2023 were the second-lowest since 2002.

Look at the January sales data; it’s not like we’re rocking into the New Year with Dick Clark here…

Nevertheless, sales were up in January of 2024 over January of 2023.

That tracks, right?

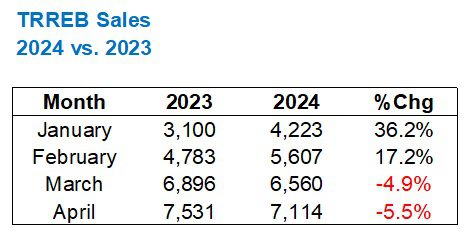

But what about February, March, and April?

Here’s where things change, and where my subsequent answers for the question, “Where have all the buyers gone?” will hold true…

Oh boy.

Sales are down year-over-year in March and April?

Yessir.

And while we were having this same conversation in 2023, it seems more important now in 2024.

Why?

Just consider March and April:

The 6,560 sales in March of 2024 are the second-lowest since 2002.

The 7,114 sales in April are the lowest, not counting the pandemic-affected year of 2020, since 2002.

Alright, so that’s more than just a “refresher” on sales data.

But are we ready to answer the cowboy question?

Where have all the buyers gone?

The way that I see it, there are six reasons why buyers aren’t out there in full force right now, so let me lay it out as follows:

–

1) The 2023 holdover buyers bought early on.

Every fall, I work with active buyers who for one reason or another, are not successful in the market.

Some of them make offers and lost in competition. Others simply can’t find what they’re looking for.

More often than not, it’s a combination of both.

But “holdover buyers” are a real thing, and we also see this with buyers who are active in the spring, then take the summer off, then are active in the fall again.

This year, I came into 2024 with several holdover buyers.

All of them have purchased.

I mean, I might have a couple of casual browsers who are always looking, but of the buyers who were jet-set on purchasing last fall and who didn’t, all of them have purchased.

And it’s now May.

The last of my “holdover buyers” purchased in early-April. Most of my holdover buyers purchased in January and February.

That seems to follow the year-over-year sales data, coincidentally or otherwise…

–

2) The new-year buyers also bought early on.

I’m not one for New Year’s Resolutions, but maybe that’s because I feel I’m perfect and don’t need to change at all.

But every January, we receive phone calls and emails from people who have made it their goal to get into the real estate market this year, and 2024 was no different.

I actually received an email from a young man on January 1st. I emailed him back and said, “You sure didn’t waste any time…”

That young many purchased a condo in the third week of January.

In fact, most of these “new year’s buyers” purchased early on, as did the “holdover buyers.”

Again, this seems to follow the year-over-year sales data.

–

3) New buyers have declined, across the board.

Put together the first two points, and if you don’t have new buyers coming out of the woodwork in March, April, and May, then it seems to reason sales will be down.

Looking at my current roster of buyer clients, I have three active buyer clients that reached out from March onward. That’s less than I would usually expect at this point in the busy spring/summer market.

Having said that, I heard from somebody in management at our brokerage who noted the uptick in new buyers attending weekend open houses, most of whom are unrepresented and “just starting their search.”

I suppose it depends on who you ask, or who’s completing this survey, but I think the statistics show that there are fewer buyers. Maybe the fairweather buyers are about to come out?

–

4) Investors are on the sidelines.

There’s a saying that I feel is quite important here:

“Smart money buyers before the rate cuts, not during, not after.”

The theory holds that once interest rates are cut, then prices rise. Most of us think that’s what’s going to happen moving forward, whether it’s this fall or next spring. But true investors who are thinking long-term realize that there’s a lot more to be gained in terms of capital appreciation than in terms of monthly carrying cost.

So where have all the investors gone?

Are they with the cowboys?

I’ve sold a couple of properties to investors this year, but the number is down for sure.

Most of my investors who are/were active are saying, “I want to see where all this shakes out.”

Patience is key. And many investors are willing to give up a bit of capital appreciation simply to take a breather right now.

–

5) Buyers are waiting for interest rate cuts.

This is the big one, right?

This is the reason that buyers have gone to wherever Paula Cole’s cowboys have gone, right?

Recall that when we discussed interest rates last month, in the blog post, “Where In The World Are Those Interest Rate Cuts?” we discussed how a spike in bond yields had caused the five-year, fixed-rate mortgage to jump about fifty basis points.

Is that enough to move the needled?

We also talked about how the difference between 4.99% and anything with a “5” in front of it might represent a “psychological barrier” of sorts.

But how does this play out in principle?

Let’s look at the first-time condo buyer who is trying to get into the market at $550,000 (and assume a 20% down payment and 25 year amortization).

At a rate of 4.99%, the monthly mortgage payment would be $2,556.56.

At a rate of 5.49%, the monthly mortgage payment would be $2,683.16.

Suffice it to say, this should not move the needle. If a buyer says “I can’t afford this lifestyle” at $2,683.16 per month but says “Bring on home ownership” at $2,556.56 per month, then there’s a problem.

Nevertheless, I do think that a lot of buyers are waiting for interest rate cuts and increased affordability.

It’s true that if and when interest rate cuts come, prices could or should increase. But many buyers don’t know this and it’s not playing a factor in their decision to wait.

–

6) Prices are too high relative to rates.

Let’s look at an example that compares the carrying cost of a house in May of 2024 to that of the same house in 2021 when rates were lower.

We all know that the “peak” of the market was in February of 2022 when the average home price hit $1,334,554, but let’s look at prices from 2021.

The average home price in May of 2021 was $1,108,453.

The average home price this past April (the last month for which we have data) was $1,156,167.

Now, let’s consider a 1.79% mortgage rate then versus a 5.29% mortgage rate now.

Assuming a 20% down payment and 25-year amortization…

May, 2021: A house bought for $1,108,453 carries for $3,665.76.

May, 2024: A house bought for $1,156,167 carries for $5,533.17

Obviously, we can play around with these numbers.

I’m looking for a typical 5-year, fixed-rate mortgage, but some people might want to compare variable rates, or look at 3-year fixed, etc.

But if you’re looking for a reason why 2021 saw the highest sales in the history of the city, that might be it.

Those interest rates were never intended to stay. There’s nothing “normal” about those rates.

Do you know what is normal?

4.99%.

But when will that normalize?

I thought it would be late-2023, but that didn’t happen. Then I figured it would be early-2024, but that hasn’t happened either.

So may I revise my prediction again? This time, to late-2024?

Wherever the buyers went, they’re not going to remain there forever.

But are they coming back this spring?

To quote Paula Cole:

“Will it be yes, or will it be…..sorr-ry….”