Where In The World Are Those Rate Cuts?

I told my son this morning, “Sharing is caring.”

I can’t believe I said that.

Honestly, I don’t even know where it came from!

Buried six layers deep in my mind, like something out of Leonardo DiCaprio’s Inception, was that line that I believe I heard my friend Jeff tell his son a decade ago, while I thought, “Geez, what happened to Jeff?”

Now I’m saying it.

Geez, what happened to me?

But if sharing is caring then I’m going to share with you today.

My mortgage is up for renewal in November of 2024.

I simply can’t believe that it’s been five years, but here we are, and boy – did it go by quickly!

I closed on my current home in August of 2018 and at the time I had a variable rate. It was really low.

But the funny thing about variable versus fixed rates is that they can fluctuate and the gap between them can expand or contract. So while I did have an excellent rate at one point, by 2019, my friend Chris was able to achieve a 5-year, fixed-rate that was lower than my variable!

How’s that for sharing?

So in late 2019, I decided to lock into a 5-year-fixed rate of 2.59%.

Yeah, I know. It sounded like I was complaining, didn’t it? I sort of was. But I was on a variable rate that was getting chewed up – at least compared to the fixed rate at the time, and while the 2.59% rate sounds incredible today, it was just so-so back then.

And now here we are, five years later.

I’m in the same boat as so many other people out there.

I’m not different. I’m not special. I’m just like you, and you, and you.

So now what?

I can lock into a 5-year, fixed-rate mortgage this November which will probably be at least 2% higher than my current rate of 2.59%.

Or I could lock into a 3-year, fixed-rate mortgage that’s likely going to be 20-40 basis points higher, but allow myself to take advantage of (potentially) lower rates in three years.

Then again, I could take a variable rate, pay through the nose in the interim, but keep the flexibility to lock into a longer-term rate when the Bank of Canada finally cuts.

Oh, yeah, about that.

Where In The World Are Those Rate Cuts?

The Bank of Canada has made six policy announcements since the last interest rate hike in July of 2023, and they have left the target rate at 5.00% all six times.

Coming into 2024, all the talk was about when rates would be cut, not if.

Recall the game we played here on TRB:

Adrian, Ed, Vancouver Keith, TO Planner, Mike, Ace Goodheart, and Addison are all eliminated from Prediction #1.

They’re still in the game for the 2nd and 3rd predictions, but April 10th has come and gone, and we haven’t seen a rate cut yet.

So will it be June?

Or will Peter, Marina, House Keys, Alex, and yours truly all be eliminated from the game as well?

While I may have bet on June 5th back at the start of the year, if I were to revise my pick today, I would say September 4th. And I might be inclined to go for October 23rd.

There’s nothing but uncertainty out there at the moment.

Especially with headlines like this:

“Bank of Canda Officials Split On Rate Cut Timing, But Agree Easing Will Be Gradual”

The Globe & Mail

April 24th, 2024

From the article:

Bank of Canada officials are split on when to start lowering interest rates, but agree the pace of cuts will likely be gradual when they do begin easing monetary policy.

A summary of the discussions that took place ahead of the April 10 rate decision show members of the bank’s governing council are becoming more confident that inflation is on a path back to the 2-per-cent target. That’s opened the door to interest rate cuts in the coming months.

However, some members of the six-person council, which is chaired by Governor Tiff Macklem, remain wary about cutting interest rates too soon, in light of a jump in domestic demand and robust growth in the United States. That suggests a rate cut at the bank’s next meeting on June 5 is not a sure thing.

Yes, and about that inflation.

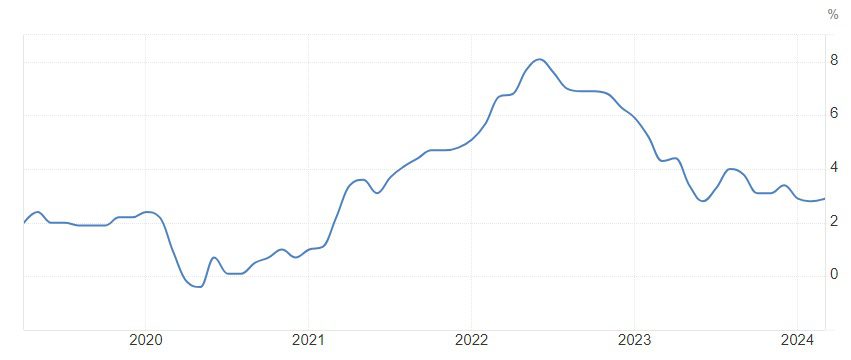

After peaking at 8.1% in June of 2022, the Canadian inflation rate is now down to a modest 2.9%.

Way too much was made about the inflation rate increasing from 2.8% to 2.9% last month.

Although I don’t think Justin Trudeau’s one-made crusade to save the planet is going to help inflation in the coming months, as gas prices continue to rise.

Inflation is almost back to pre-pandemic levels:

And if you compare the Canadian rate to the American rate, we’re ahead:

The target has always been 2.0% and the Canadian government continues to echo this, especially in the context of interest rate cuts.

The Bank of Canada report from April noted that the governing council didn’t agree on everything but did agree on the path:

While there was a diversity of views about when conditions would likely warrant cutting the policy rate, they agreed that monetary policy easing would probably be gradual, given risks to the outlook and the slow path for returning inflation to target.

Tiff Macklem also explained that while interest rates increased by 475 basis points from the first increase on March 3rd, 2022, through the tenth increase on July 7th, 2023, the reduction in the overnight lending rate wouldn’t be nearly as quick.

The current rate of 5.00% is the highest its been in twenty-one years.

Another couple of comments to note from the Globe & Mail article:

“Past rate-cutting cycles have often been fast and furious, with rapid easing required to offset a major shock to the economy,” Royce Mendes, head of macro strategy at Desjardins, wrote in a note to clients.

“This time policy makers are not yet faced with a recession and need to balance the risk that inflation heats back up or gets stuck at an elevated level as rates fall.”

And that’s exactly the problem.

Personally, I have long-maintained the Bank of Canada knows as soon as they start to cut interest rates, the real estate market is going to explode.

I know that there are still real estate bears on TRB and that’s fine. But I’m going on record here: a rate cut of 100-150 basis points is going to get the average home price in Toronto back up near the peak from February of 2022.

The irony is, all the talk in Ottawa is about housing affordability!

That federal budget from two weeks ago was an absolute joke.

A lot of people asked me why I didn’t blog about it, but I can’t. It’s not productive. And it risks being extremely divisive, which I really don’t want.

But the Bank of Canada is going to cut rates. We know this.

We just don’t know when.

And we don’t know by how much.

Last week, our friends from Outline Financial presented us with their economic report from April.

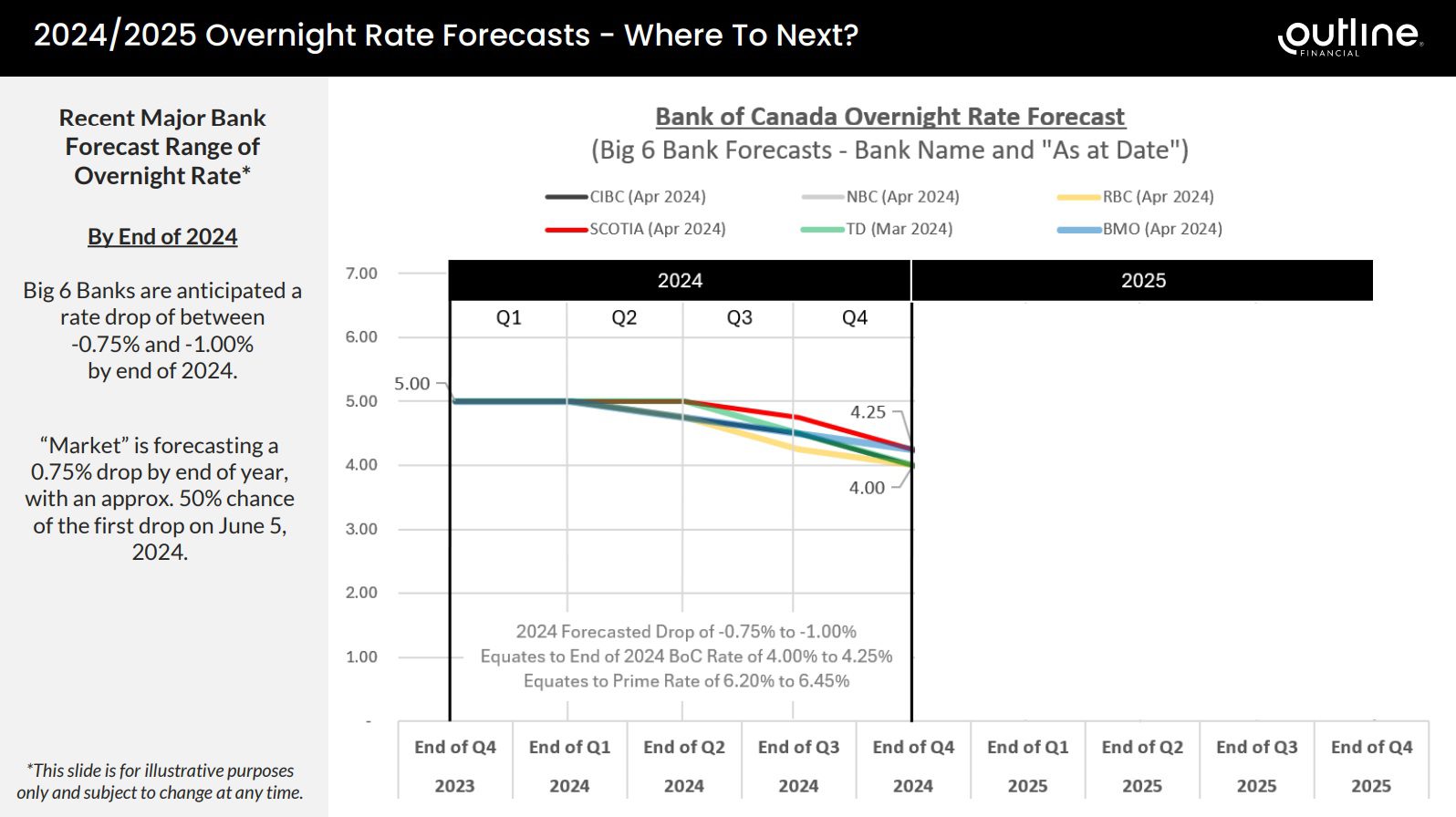

I’d like to share a couple of those slides with you, starting with a look at the 2024 forecast for the overnight lending rate:

Their slide shows that the market is forecasting a 50% chance of the first rate cut on June 5th, 2024.

This is in line with the financial markets, which according to the Globe & Mail article, put the odds at 45% what it’s worth, the financial markets are putting the odds of a rate cut in July at 80%).

But according to Outline Financial, the Big-6 banks are expecting a total rate reduction of 75 to 100 basis points by the end of 2024.

That’s good, right?

Except for those of us with mortgage renewals in November…

Like I said: I’m no different than you.

TD Bank, RBC, and NBC are expecting to see a 100 basis-point drop.

Scotia, BMO, and CIBC are expecting to see a 75 basis-point drop.

Keep in mind, this only directly translates to a similar decline in the variable rate. The fixed-rates work off the bond market, and while a reduction in the overnight lending rate will undoubtedly affect the bond market, it’s not a penny-for-penny correlation.

As we get into 2025, the outlook is much better for those of us who do want to see lower rates:

TD Bank is projecting the largest cumulative rate cut, with a target of 2.25%, down 275 basis points from where the overnight lending rate stands today.

BMO is projecting the lowest cumulative rate cut, and oddly, it looks as though this chart suggests a rate increase in the 3rd quarter of 2025. It also shows a rate increase prediction in the 4th quarter of 2025 by Scotia. Very odd.

According to Outline Financial’s note in the left-hand margin, the financial markets are only predicting a 150 basis-point drop by the end of 2025, compared to the banks, which are anywhere from 150 to 275 points.

So can we split the pot here?

Can we agree that the current overnight lending rate of 5.00% will be below 3.00% by the end of 2025? Or, at least that’s what we can agree to expect, based on the predictions of the banks?

How many of you are salivating at the thought of a 5-year, fixed rate of 2.99% right now?

I know that I am.

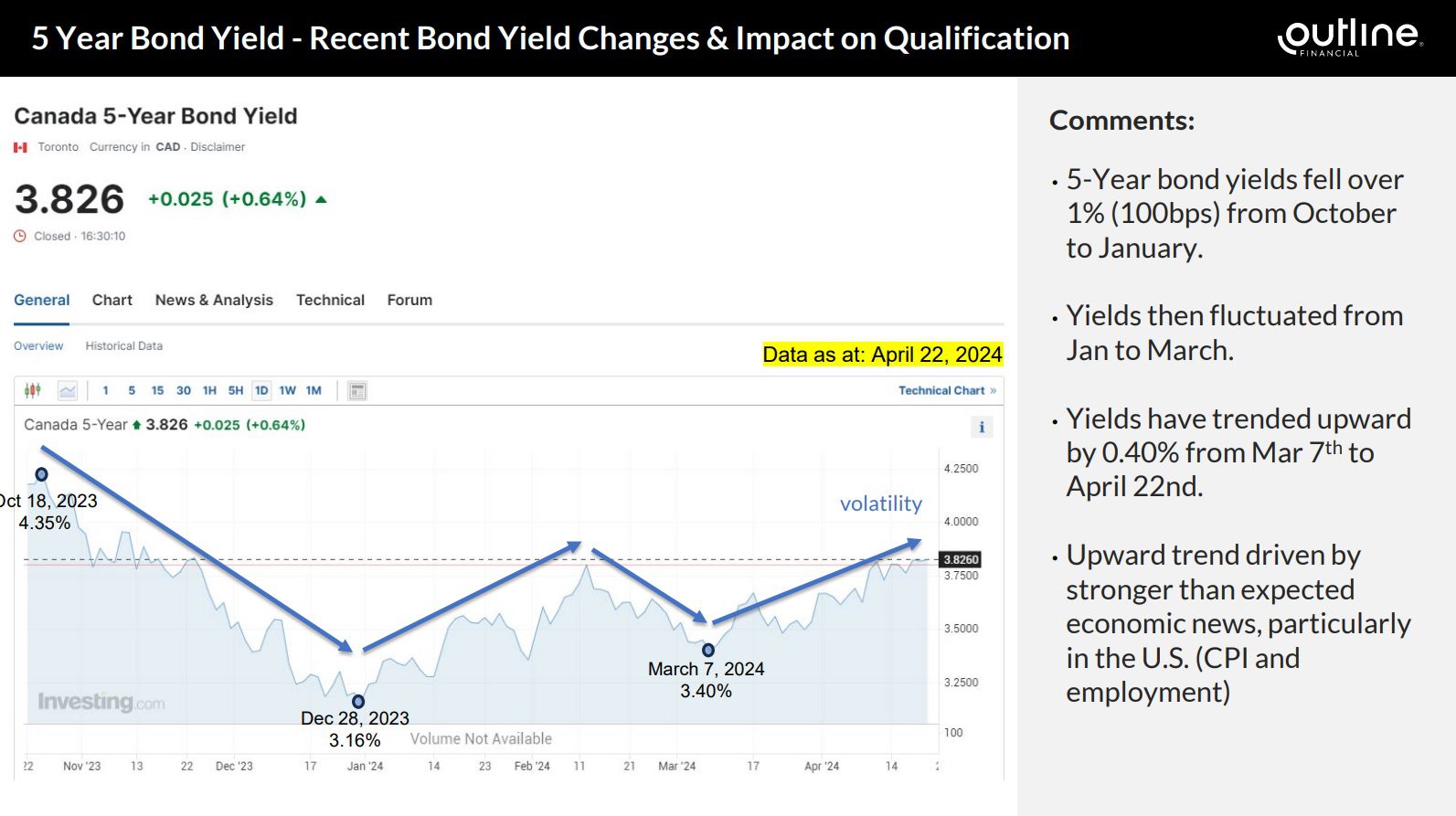

But as we know, the overnight lending rate and Prime rates directly affect variable rate mortgages. For insight into fixed rate mortgages, we need to consider bond yields.

Let’s check out the next slide:

Last fall, bond yields dropped like Brad Marchand after a gentle tap to the back of the leg.

119 basis-points from October to December! That’s more impressive than a Toronto Maple Leafs’ playoff win!

But the volatility is what I find interesting int he above slide, and it seems as though Outline Financial did as well. We’ve seen down, up, down, and up since October, and while the subsequent three fluctuations are insignificant compared to that first 119 basis-point decline, it shows that there’s a major difference between your fixed-rate mortgage today and that of tomorrow or the day after.

An increase of 40 basis-points from March was not something that I expected.

It’s ironic, considering all the talk out there is about “interest rate cuts,” and yet higher bond yields have led to higher fixed-rate mortgages.

So back to that idea of salivating over a 2.99%, five-year, fixed-rate mortgage.

Any predictions for when that becomes a reality again? Is this the end of 2025? The end of 2026? Or should we not expect to see that again?

So what should I do in November of 2024? Take the one-year fixed?

Decisions, decisions!

In the Bank of Canada announcement in April, they finished with this:

“Based on the outlook, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months. The Council will be looking for evidence that this downward momentum is sustained. Governing Council is particularly watching the evolution of core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour. The Bank remains resolute in its commitment to restoring price stability for Canadians.”

So it’s not just about inflation.

It’s about supply and demand, wages, and corporate pricing as well.

Lower interest rates will absolutely vault demand across the board, especially in the housing market, as I’ve said.

The more I read from the Bank of Canada, the less convinced I am that a rate cut is coming in June.

Now, does anybody care to state or revise a prediction?